Practice Update March 2025

Do bucket companies help build wealth at retirement?

Bucket companies are familiar with wealth-building strategies, particularly as individuals approach retirement. By distributing profits to a bucket company, individuals can benefit from reduced tax liabilities and enhanced investment growth opportunities. This essay explores how bucket companies influence wealth building at retirement, their impact on age pension eligibility and tax positions, and strategies to maximise economic outcomes.

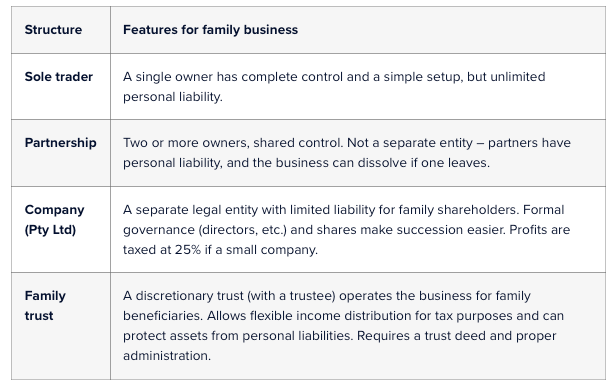

Understanding bucket companies

A bucket company is used to receive distributions from a family trust. Instead of distributing profits directly to individuals, which may attract high marginal tax rates, the trust distributes income to the bucket company, which is taxed at the corporate tax rate (currently 30% or 25% for base rate entities). The company can then retain the after-tax profits for reinvestment or distribution.

Impact on wealth building at retirement

Tax efficiency and compounding growth

Using a bucket company can result in significant tax savings compared to personal marginal tax rates, reaching up to 47% (including the Medicare levy). Retained earnings within the bucket company are taxed lower, allowing more capital to compound over time.

Example of Tax Efficiency:

Income DistributedPersonal Marginal Tax (47%)Bucket Company Tax (25%)Savings$100,000$47,000$25,000$22,000

Over 20 years, if the tax savings of $22,000 per year are reinvested at an annual return of 7%, they would accumulate to approximately $1,012,000.

Age pension and means testing

The age pension is subject to both an income test and an assets test. Holding wealth in a bucket company can impact these tests:

- Income Test: Distributions to individuals count as assessable income. Retained profits within the company do not.

- Assets Test: The value of the bucket company shares is counted as an asset, which may affect pension eligibility.

Strategic use of the company can help individuals control their assessable income, potentially increasing their age pension entitlement.

Strategies to maximise economic outcomes

- Timing of Distributions

By deferring distributions from the bucket company until retirement, individuals can benefit from lower marginal tax rates or effectively use franking credits.

- Dividend Streaming

Using franking credits from company-paid tax can reduce personal tax liabilities when distributed dividends.

- Investment within the Company

Reinvesting retained earnings within the bucket company in diversified assets can enhance compounding returns.

- Family Trust Distribution Planning

Strategically distributing income to lower-income family members before reaching the bucket company can reduce overall tax.

- Winding Up or Selling the Company

Carefully planning an exit strategy to wind up the bucket company or sell its assets can minimise capital gains tax liabilities.

Example of a retirement strategy with a bucket company

Assume that John and Mary, aged 65, have distributed $100,000 annually from their family trust to their bucket company over 20 years.

- Corporate tax paid: 25%

- Annual return on reinvestment: 7%

- After-tax reinvested earnings annually: $75,000

YearAnnual ReinvestmentTotal Accumulated Amount (7% p.a.)5$75,000$435,30010$75,000$1,068,91420$75,000$3,867,854

At retirement, they can distribute dividends with franking credits to minimise personal tax and supplement their income while potentially qualifying for some age pension benefits due to strategic income timing.

FAQ

- What is a bucket company? A bucket company is a corporate entity that receives trust distributions, taxed at the corporate rate rather than personal marginal rates.

- How does a bucket company impact my age pension eligibility? While retained earnings do not affect the income test, the value of the company shares is considered an asset under the assets test.

- Can bucket companies help reduce tax during retirement? Yes, by using franking credits and strategic distribution timing, bucket companies can minimise tax liabilities.

- Are there risks associated with using bucket companies for retirement planning? Yes, risks include changes in tax laws, corporate compliance costs, and potential capital gains tax upon winding up the company.

- Should I consult a professional before using a bucket company? Absolutely. Professional advice is essential to ensure compliance with tax laws and optimise wealth-building strategies.