Practice Update January 2026

A real-world case study on trust distributions

Mark and Lisa had what most people would describe as a “pretty standard” setup.

They ran a successful family business through a discretionary trust. The trust had been in place for years, established when the business was small and cash was tight. Over time, the business grew, profits improved, and the trust started distributing decent amounts of income each year.

The tax returns were lodged. Nobody had ever had a problem with the ATO.

So naturally, they assumed everything was fine.

This is where the story starts to get interesting.

Year one: the harmless decision

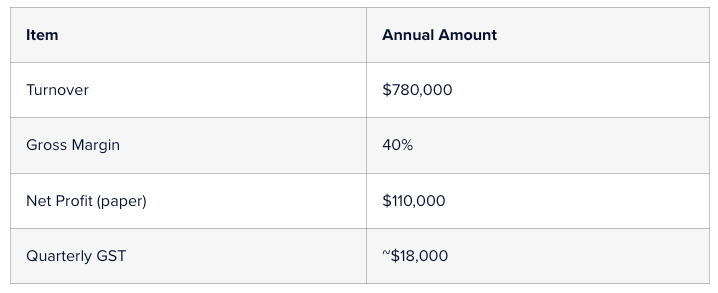

In a good year, the business made about $280,000.

It was suggested that some income be distributed to Mark and Lisa’s two adult children, Josh and Emily. Both were over 18, both were studying, and neither earned much income.

On paper, it made sense.

Josh received $40,000.

Emily received $40,000.

The rest was split between Mark, Lisa, and a company beneficiary.

The tax bill went down. Everyone was happy.

But here’s the first quiet detail that mattered later.

Josh and Emily never actually received the money.

No bank transfer. No separate accounts. No conversations about what they wanted to do with it. The trust kept the funds in its main business account and used them to pay suppliers and reduce debt.

At the time, nobody thought twice.

“It’s still family money.”

“They can access it if they need it.”

“We’ll square it up later.”

These are very common thoughts. And this is exactly where risk quietly begins.

Year two: things get a little more complicated

The next year was even better.

They used a bucket company to cap tax at the company rate. Again, a common and legitimate strategy when used properly.

So the trust distributed $200,000 to the company.

No cash moved. It was recorded as an unpaid present entitlement. The idea was that the company would get paid later, when cash flow allowed.

Meanwhile, the trust needed funds to buy new equipment and cover a short-term cash squeeze. The trust borrowed money from the company. There was a loan agreement. Interest was charged. Everything looked tidy on paper.

From the outside, it all seemed sensible.

But economically, nothing really changed.

The trust made money.

The trust kept using the money.

The same people controlled everything.

The bucket company never actually used the funds for its own business or investments.

This detail becomes important later.

Year three: circular money without anyone realising

By year three, things had become routine.

Distributions were made to the kids again.

The bucket company received another entitlement.

Loans were adjusted at year-end through journal entries.

What is really happening is a circular flow.

Money was being allocated to beneficiaries, then effectively coming back to the trust, either because it was never paid out or because it was loaned back almost immediately.

No one was trying to hide anything.

No one thought they were doing the wrong thing.

They were just following what they’d always done.

This is how section 100A issues usually arise. Slowly, quietly, and without any single dramatic mistake.

The ATO letter arrives

One day, Mark received a letter from the ATO.

It wasn’t an audit notice.

It wasn’t aggressive.

It was a “review”.

The letter asked for:

• trust deeds

• distribution resolutions

• loan agreements

• bank statements

• explanations of how beneficiaries benefited from distributions

Mark wasn’t worried at first.

“We’ve got nothing to hide.”

But when they sat down to respond, things became uncomfortable.

Josh and Emily were asked:

“Did you receive the trust distributions?”

“Did you know about them?”

“Did you decide what to do with the money?”

Their answers were honest.

“I didn’t really think about it.”

“Mum and Dad handled it.”

“I didn’t get the cash.”

That honesty, unfortunately, worked against them.

The ATO’s view

The ATO didn’t argue that the trust deed was invalid.

They didn’t argue that the resolutions were late.

They didn’t argue that tax returns were lodged incorrectly.

Instead, they focused on one simple question:

Who actually benefited from the trust income?

In the ATO’s view:

• The adult children were beneficiaries on paper only.

• The bucket company never truly benefited.

• The trust controllers enjoyed the economic benefit.

• The arrangements were not ordinary family dealings.

This pointed directly to section 100A.

The result?

The ATO proposed to ignore several years of trust distributions and assess the trustee at the top marginal rate on those amounts.

That tax bill was much larger than anyone expected.

“But we paid tax already”

This was Mark’s biggest frustration.

“The kids paid tax.”

“The company paid tax.”

“How can we be taxed again?”

This is one of the hardest parts of Section 100A to explain.

When section 100A applies, the law treats the beneficiary as if they were never entitled in the first place. That means the trustee is taxed instead, even if someone else already paid tax.

Refunds might be possible later, but cash flow damage happens immediately.

This is why section 100A is so powerful, and so dangerous if misunderstood.

What could they have done differently?

Looking back, none of the decisions were outrageous.

But small changes would have made a big difference.

Paying beneficiaries properly

If Josh and Emily had actually received the money and controlled it, the risk would have dropped significantly.

That doesn’t mean parents can’t help later.

It means the beneficiary must genuinely benefit first.

Making bucket companies real

If the company had used the funds for its own investments or working capital, rather than acting as a parking place, the arrangement would have looked very different.

A company beneficiary needs a purpose beyond tax.

Even with an accountant, trustees still make decisions.

You should always feel comfortable asking:

• Who is this distribution really benefiting?

• Will the money actually be paid?

• Does this arrangement still make sense if tax wasn’t a factor?

Good advisers welcome these questions.

The simple takeaway

Section 100A isn’t about trickery.

It’s about reality.

If trust income is allocated one way but enjoyed another way, the ATO may step in and rewrite the outcome.

The safest trust arrangements are boring ones.

Money goes where the paperwork says it goes.

Beneficiaries know what they’re receiving.

Companies act like real companies.

If your trust arrangements have evolved over time, or if you’re not quite sure where past distributions ended up, it’s worth reviewing them sooner rather than later.

Fixing things early is almost always easier than explaining them under review.

Advice warning: This update is general information only and does not constitute tax advice. Specific advice should be obtained before acting on the matters discussed.