Practice Update February 2026

Readiness strategies in preparation for the Payday Super

If you run a small business, paying Superannuation can feel like “one more admin job” on top of payroll, BAS and everything else. Two key changes mean Superannuation deserves a fresh look this year:

- The Super Guarantee (SG) rate is 12% for 1 July 2025 to 30 June 2026 (and remains 12% after that).

- From 1 July 2026, “Payday Super” starts — employers will be required to pay SG on payday, rather than quarterly, and contributions must be paid into the employee’s fund within 7 days of payday.

What does SG at 12% mean in everyday terms?

SG is calculated on an employee’s Ordinary Time Earnings (OTE) (often the base rate and ordinary hours, plus certain loadings/allowances depending on how they’re paid). The key point for most businesses is that the Superannuation cost is now 12 cents for every $1 of OTE.

If you haven’t already, it’s worth confirming whether your staff packages are “plus super” (super on top) or “inclusive of super” (rare, but it happens). A small misunderstanding here can quietly create underpayments.

What is “Payday Super” and why is it changing?

Many employers pay the Superannuation Guarantee (SG) quarterly. Payday Super changes the rhythm:

- From 1 July 2026, each time you pay OTE to an employee, it creates a new super payment obligation for that payday.

- You’ll have a 7-day due date for the SG to arrive in the employee’s fund after each payday (this is designed to allow time for payment processing).

- The ATO is implementing the change, and guidance is already being published to help employers prepare.

This reform is aimed at reducing unpaid super and making it easier for workers to see whether super has actually been paid, closer to when they’re paid wages.

Quarterly vs payday Super

Scenario 1: Weekly payroll at a café (the “tight cash flow” case study)

Business: Corner Café

Staff: 8 casuals + 2 full-time

Payroll cycle: Weekly (paid every Friday)

Current method: Super paid quarterly

What happens today (typical):

The café pays wages weekly, but super might be parked in a separate “later” bucket and paid in one quarterly lump. That can create a large cash outflow four times a year, and if the owner is juggling rent, suppliers, and GST, super can slip.

What changes from 1 July 2026:

Each Friday, payroll creates a super obligation, and the café must ensure the super payment reaches each employee’s fund within 7 days.

A simple numbers example (rounded for illustration):

- Suppose the café pays $12,000 of OTE wages in a week.

- SG at 12% is $1,440 that week.

Under Payday Super, the café can no longer treat that $1,440 as a “quarter-end problem”. It needs to be funded weekly.

Practical impact (and how many cafés will handle it):

- Cash flow smoothing: The good news is the café avoids the painful “quarterly super cliff.” Instead, super becomes a predictable weekly cash flow item—like wages.

- Systems matter: The payroll software or clearing house process must be fast and reliable, because the new timing expectations are tighter.

- Delegation and controls: Owners who do payroll themselves often need a backup person and a simple “pay run checklist” so super isn’t missed when life gets busy.

A café-friendly control idea:

Open a separate bank account called “Tax + Super Set-Aside” and automatically transfer (for example) 12% of OTE + estimated PAYG withholding immediately after each pay run. It reduces the temptation to use super money for short-term bills.

Scenario 2: A plumbing business with monthly payroll (the “admin-heavy” case study)

Business: Rapid Response Plumbing

Staff: 6 employees

Payroll cycle: Monthly (paid on the last working day)

Current method: Super paid quarterly using a clearing house

What happens today (typical):

Monthly payroll is manageable, but super is handled as a quarterly routine. Admin time is batched up: one “super session” per quarter, usually involving checking fund details and uploading a payment file.

What changes from 1 July 2026:

That quarterly super session becomes monthly (because wages are monthly). Each monthly pay run triggers a due date within 7 days after payday.

What this business will notice first:

- More frequent admin: Instead of 4 super payments a year, it becomes 12.

- Less catch-up: Quarterly “cleanup” (fixing wrong fund details, chasing TFNs, sorting stapled fund issues) becomes a more continuous process.

- Fewer nasty surprises: Issues show up sooner, because you’re not leaving super for 8–12 weeks.

How a plumbing business can make this painless:

- Tidy the data now: Confirm each employee’s correct super fund details and ensure onboarding captures the right information up front.

- Automate where possible: If your payroll system can create super payment files or integrate with your payment process, turn it on and test it well before July 2026.

- Create an exception report: Each month, run a quick check for employees with changes to pay conditions (bonuses, allowances, backpay), as these can affect OTE and super.

What employees will notice (and what employers should expect)

With Payday Super, employees are likely to ask:

- “Should my super show up right after I’m paid?”

- “Why hasn’t last week’s super hit my fund yet?”

The 7-day window is intended to account for processing time, so there may still be a short lag between payday and when the contribution appears in the fund.

For employers, the biggest shift is that super becomes part of the normal pay-cycle discipline, not a quarterly admin job.

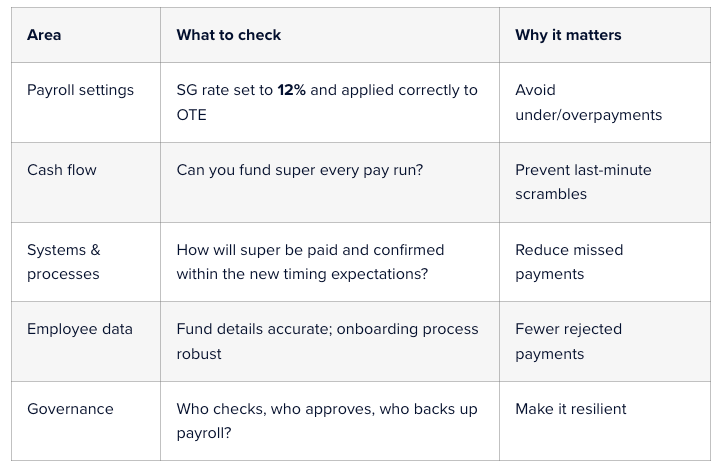

Readiness checklist for small business (do this before 30 June 2026)

Final takeaway

SG at 12% is already here, and Payday Super from 1 July 2026 is a genuine operational change, especially for businesses used to quarterly super. The winners will be the employers who treat this like a payroll project: tighten data, automate where possible, and adjust cash flow habits so super is funded each pay run.