Practice Update May 2025

Strategies for individuals before June 30, 2025

As June 30 approaches, we focus on how individuals can reduce taxable income. Thoughtful planning can make a difference. In this article, we will explore practical strategies for maximising your deductions before the end of the 2025 financial year, backed by examples and simple explanations.

Understand what you can claim

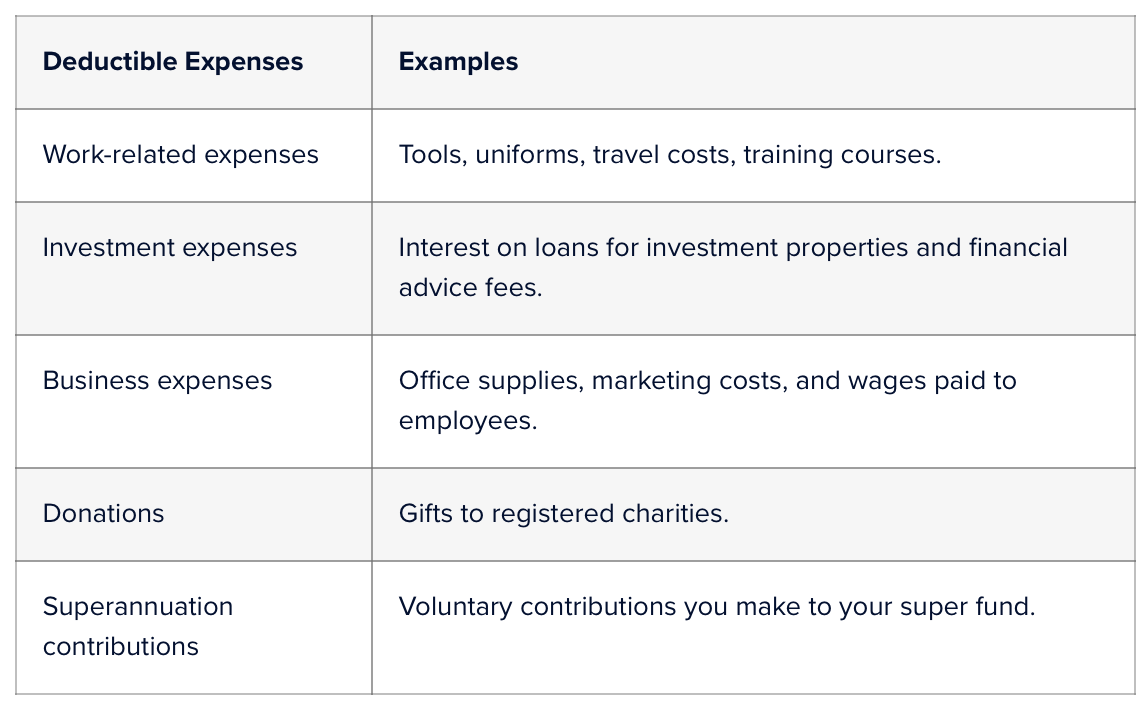

Before diving into strategies, you must know what deductions you are entitled to claim. The ATO allows you to claim deductions for expenses directly related to earning your income. This includes:

A key principle is that the expense must not be private in nature, and you must have a record to prove it.

Case study

A freelance graphic designer, Emma bought a new laptop for her business for $2,500. She uses it 90% for work and 10% for personal use. She can claim 90% of the purchase price, or $2,250, as a deduction.

Bring forward expenses where possible

If you expect your income to be the same or lower next year, bringing deductible expenses into this financial year often makes sense.

You might:

- Prepay up to 12 months of expenses, such as rent for your business premises, subscriptions, or insurance.

- Purchase essential business equipment now rather than after July 1.

- Pay for professional development courses or seminars early.

Example

Jason owns a plumbing business. He knows he needs to renew his $1,200 public liability insurance in July, but he can claim it in this year’s tax return by paying it in June instead.

Boost your super and enjoy tax benefits

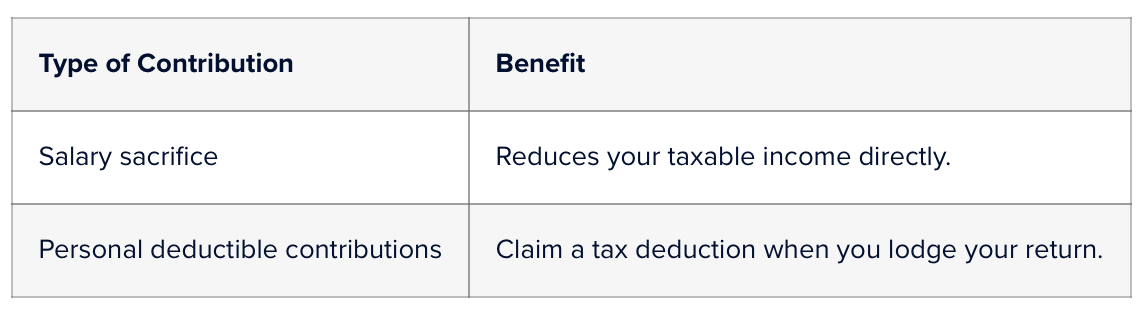

Making extra superannuation contributions is a powerful way to reduce your taxable income. In 2025, the concessional (before-tax) contributions cap is $30,000. This includes your employer’s Super Guarantee payments and your salary sacrifice contributions.

You can also make catch-up contributions if you haven’t used your full concessional cap in the past five years and your super balance is under $500,000. The table below summarises the types of contributions and related benefits.

Case study

Lily earns $110,000 a year. She has contributed only $15,000 to her super this year (via her employer). She decides to make an extra $10,000 personal contribution before the end of June. She submits a Notice of Intent to her super fund and claims a deduction, reducing her taxable income to $100,000.

Note

You must ensure your super fund receives the contributions before June 30. Bank processing delays can cause missed opportunities.

Maximise motor vehicle deductions

If you use your car for work purposes, claim the correct deductions. There are two primary methods:

- Cents per kilometre method (up to 5,000 business kms per year)

- Logbook method (track business vs personal use for at least 12 weeks)

Choosing the correct method can significantly impact your deduction.

Example

Ben, a sales representative, keeps a detailed logbook and shows that 70% of his car’s use is for business. His running costs for the year are $10,000, covering fuel, registration, insurance, repairs, and other expenses. He can claim $7,000 (70% of $10,000) as a deduction.

Make donations to registered charities

If you’re feeling generous, donating to a Deductible Gift Recipient (DGR) charity before June 30 can reduce your tax bill. Donations of $2 or more are tax-deductible, but be sure to keep your receipts.

Tip

Donations must be monetary or specific, eligible items. Raffles, fundraising event tickets, and crowdfunding support often do not qualify for deductions.

Example

Joan donates $500 to the Red Cross and receives a receipt. She can claim the full $500 as a tax deduction.

Keep good records

No matter how good your deductions are, the ATO can deny them without evidence.

Make sure you:

- Keep receipts, invoices, and bank statements.

- Use apps or accounting software to track expenses.

- Keep vehicle logbooks and work-from-home records.

The ATO generally requires records to be kept for a minimum of five years.

Tip

Keep the record if you’re unsure whether an expense is deductible. A good accountant can help clarify things at tax time.

The countdown to June 30 is on. With some planning, you can significantly reduce your tax bill, boost your savings, and set yourself up for a stronger financial year. Everyone’s situation is different, so getting personalised advice from a qualified accountant or tax agent is smart. Small moves today can lead to significant savings tomorrow.

Strategies for small businesses

Small businesses have unique opportunities to manage their tax position before the end of the financial year. By taking action now, you can legally minimise your tax, improve cash flow, and set yourself up for success in 2026. Here are several practical strategies to consider.

Take advantage of the instant asset write-off

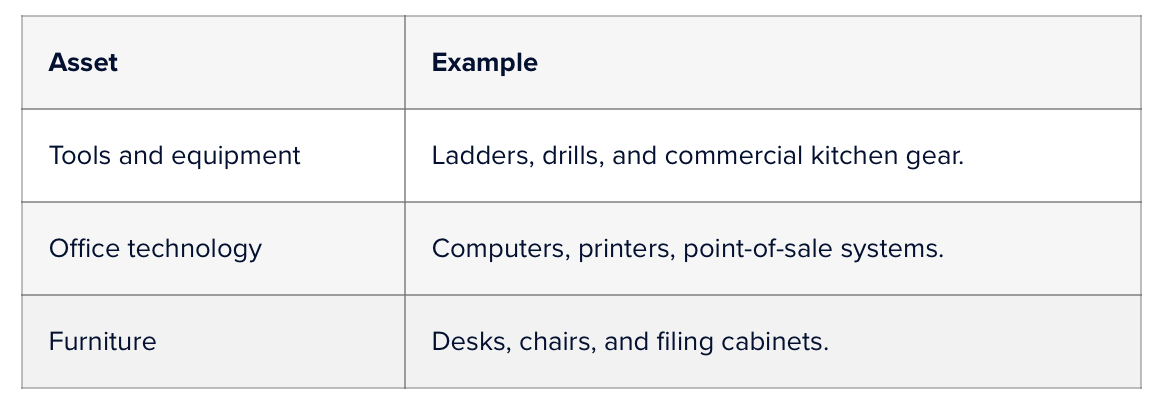

If your business turnover is under $10 million, you may be eligible to claim an immediate deduction for assets costing less than $20,000 each.

Common examples

This is paragraph text. Click it or hit the Manage Text button to change the font, colour, size, format and more. To set up site-wide paragraph and title styles, go to Site Theme.