Practice Update June 2022

P r a c t i c e U p d a t e June 2022

ATO priorities this tax time

The ATO has announced four key areas that it will be focusing on for Tax Time 2022:

- Record-keeping.

- Work-related expenses.

- Rental property income and deductions.

- Capital gains from crypto assets, property, and shares.

Before claiming income tax deductions for their expenses, taxpayers must ensure:

- they spent the money themselves and were not reimbursed;

- if an expense is for both income-producing and private use, only the portion relating to producing income is claimed; and

- they have a record to prove it.

Avoid double dipping on your deductions

Taxpayers are reminded not to make the mistake of ‘double dipping’ on deductions (that is, claiming expenses twice) in their tax return this year.

Some of the ‘double dipping’ mistakes commonly made relate to the following deductions:

- Working from home expenses

A common mistake involves using the 'shortcut method' to claim working from home expenses and then claiming additional amounts for expenses such as mobile phone and internet bills, as well as the decline in value of equipment and furniture.

The working from home shortcut method is all-inclusive.

There are three methods available to claim a deduction for working from home expenses depending on individual circumstances; namely, the shortcut, fixed rate and actual cost methods.

The method that gives the best outcome can be used, as long as the eligibility and record-keeping requirements for the chosen method are observed.

- Car expenses

A common mistake involves using the 'cents per kilometre' method to claim car expenses, and then double dipping by separately claiming expenses such as fuel, car insurance, and registration.

The cents per kilometre rate is all-inclusive and already covers decline in value, registration, insurance, maintenance, repairs, and fuel costs.

- Reimbursed expenses

Taxpayers cannot claim expenses that have already been reimbursed by their employer.

Get ready for super changes from 1 July 2022

As the new financial year approaches, employers need to be aware of two important super changes.

From 1 July 2022, employees can be eligible for super guarantee (‘SG’), regardless of how much they earn, because the $450 per month eligibility threshold for when SG is paid has been removed.

Employers only need to pay super for workers under 18, when they work more than 30 hours in a week.

Furthermore, the SG rate will increase from 10% to 10.5% on 1 July 2022. Employers will need to use the new rate to calculate super on payments made to employees on or after 1 July, even if some or all of the pay period is for work done before 1 July.

Employers should update their payroll and accounting systems to ensure they continue to pay the right amount of super for their employees.

ATO to start clearing backlog of ENCC release authorities

Due to "unavoidable delays caused by improvements to" its systems, the ATO will start issuing requests to release excess contributions and other charges for individuals who did not make an election on the tax treatment of their excess non-concessional contributions ('ENCC') for prior financial years.

This may result in a higher than normal number of release authorities for members of superannuation funds over the coming months while the ATO works through the backlog.

ATO warns about GST fraud

Taxpayers are being warned to be on the lookout for dodgy online ads, often on social media platforms, promising easy GST refunds.

The ATO recently issued a media release about large-scale GST fraud attempts exceeding $850 million, that involve customers setting up an ABN without operating a business, and then submitting fictitious BAS statements to get a GST refund.

The ATO said it has already successfully stopped $770 million in attempted fraud before payment.

“The people who are involved in these activities aren’t accidentally ticking a box on an online form. They’re signing to say that they’ve set up an ABN for a business that doesn’t exist, then lodging a BAS with false information on it, to receive GST refunds that they are not entitled to,” the ATO said.

Taxpayers who think they’ve been involved in this arrangement are urged to let the ATO know (before the ATO contacts them) by calling 1300 130 017.

Confidential reports of suspected tax evasion or crime can be made online (visit ato.gov.au/tipoff) or by calling the ATO’s Tax Integrity Centre on 1800 060 062.

Employers need to prepare for changes under STP expansion

Single Touch Payroll ('STP') reporting has been expanded.

This expansion, known as ‘STP Phase 2’, means that employers will need to start reporting extra information to the ATO each time they run their payroll.

Some digital service providers (‘DSPs’) needed more time to update their products and applied for deferrals, which cover their customers – therefore, when an employer can start Phase 2 reporting depends on when their payroll product is ready.

Employers that have not already started Phase 2 reporting should ask their DSP when their product will be ready (if they don't already know).

Employers need to be across the changes and get ready to start Phase 2 reporting. This includes:

- checking if changes need to be made to payroll pay codes/categories so they align with Phase 2 requirements;

- reviewing allowances employers pay and how they need to be reported in Phase 2;

- understanding changes to salary sacrifice reporting; and

- understanding how to assign an income type to each payment.

The ATO is also reminding employers that amounts paid to 'closely held payees' should now be reported through STP.

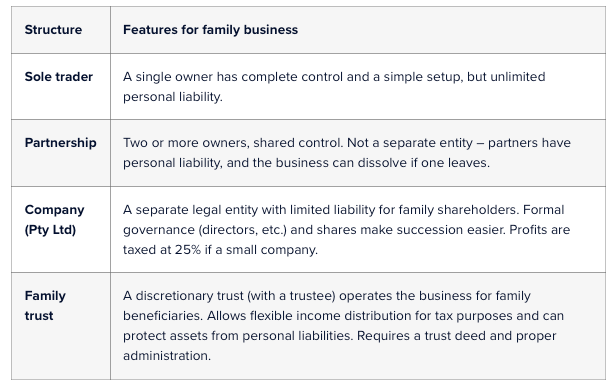

A ‘closely held payee’ is an individual directly related to the entity they receive payments from. For example, family members of a family business, directors or shareholders of a company and beneficiaries of a trust..

There are concessional reporting options for closely held payees reporting which include the following:

- Reporting actual payments on or before the date of payment (along with arm's length employees).

- Reporting actual payments quarterly.

- Reporting a reasonable estimate quarterly.

Editor: Should you have any questions (or require any assistance) about any of the issues raised in this update, please feel free to contact our office.