December 2020

Ian Campbell • 30 November 2020

TAX BREAKS FOR BUSINESS IN THE OCTOBER FEDERAL BUDGET

Extension of instant asset write-off

Business with aggregated annual turnover of up to AUD $5 billion can now instantly write off eligible asset purchases without cost limit, meaning they are now able to deduct the full cost of eligible depreciable assets of any value in the year they are installed.

This applies to assets purchased from 7:30pm AEDT on 6.102020 until 30.6.2022. Eligible assets will be new depreciable assets and the cost of improvements to certain existing assets. For small and medium-sized businesses with an aggregated annual turnover of less than $50 million, full expensing also applies to second-hand assets.

Businesses with aggregated turnover between $50m and $500m can still deduct the full cost of eligible second-hand assets costing less than $150,000 that are purchased by 31.12.2020 under the enhanced instant asset write-off. Businesses that hold assets eligible for the enhanced $150,000 instant asset write-off will have an extra six months, until 30.6.2021, to first use or install those assets.

Small businesses (with aggregated annual turnover of less than $10 million) are able to deduct the balance of their simplified depreciation pool at the end of the income year while full expensing applies. This is a significant concession.

These measures are expected to incentivise investment in the full range of business assets including plant and equipment, furniture and fittings and motor vehicles and other transport equipment.

JobMaker hiring credit

Also announced in the October Federal Budget is a capped, 12-month hiring credit or wage subsidy for businesses that hire ‘eligible’ employees. This applies to young people aged between 16 and 35 who in the last 3 months prior to being hired on the JobSeeker unemployment program, receiving youth allowance or a parenting payment.

Employers will receive $200 per week for new eligible employees aged between 16 and 29, and a $100 per week for those aged between 30 and 35.

This will be administered as a credit via Australia’s adoption of the Single Touch Payroll platform. Companies already taking part in the JobKeeper scheme are ineligible for this hiring credit.

Loss carry-back provisions

This budget measure will allow eligible companies to carry back tax losses from the 2019-20, 2020-21- or 2021-22-income years, to offset previously taxed profits in 2018-19 or later income years.

Corporate tax entities with an aggregated turnover of less than $5 billion will be eligible. The loss carry-back will generate a refundable tax offset in the year in which the loss is made.

The tax refund will be available for eligible businesses that elect for it when they lodge their 2020-21 and 2021-22 tax returns.

Research and development

The research and development (R&D) tax incentive will change from 1.7.2021. Small R&D entities will be entitled to an offset of 18.5 percentage points above their tax rate with no refundable limit. Large R&D entities will have intensity tiers reduced from three to two, with offsets of 8.5 and 16.5 percentage points above their tax rate.

THE EMPLOYER/CONTRACTOR ISSUE

MWWD and Commissioner of Taxation [2020] AATA 4169

In this A.A.T case it was found that the party contracting with the taxpayer was not an employee in the period under review. The company provided repair and maintenance services to businesses operating machinery. While some service technicians were employed by the company under conventional contracts of employment, other technicians were said to be independent contractors.

The key issue was whether in respect of a particular technician’s arrangement the company was liable to pay superannuation guarantee. While the technician performed all of the work himself, the applicable contact specified he had the right to delegate the work to others and there was no reason on the evidence to suppose the company would have unreasonably prevented the technician from taking on an apprentice, hiring an employee or engaging a subcontractor. It was concluded that it was not a contact “wholly or principally for the labor of the person…”, meaning the superannuation guarantee did not apply.

TAX CRIME PROSECUTION CASE STUDIES

Two recent cases outline the determination of the ATO to prosecute fraud cases for relatively low amounts.

These unedited cases from the ATO’s website send a clear message to the community – if you engage in tax fraud… Do not think you will get off with a warning, expect to find yourself in a court of law!

October 2020 – Tax cheat caught and convicted

A South Australian woman has narrowly escaped jail after making a series of false claims on her 2015- and 2016-income tax returns.

For the 2014–15 financial year, Ms Jennah Gordon significantly overstated both the amount of money she had earned and the amount of tax her employer had withheld from her. She also made a number of false claims relating to work-related car, clothing, self-education and other expenses. As a result, she received an income tax credit of $1,430 she was not entitled to.

The following year, Ms Gordon made an amendment to her 2015 tax return, inflating the amounts for ‘salary and wages’ and ‘tax withheld’ even further to obtain a larger refund. She also lodged another false tax return for the 2015–16 financial year – but these refunds were not paid, as the ATO had already commenced an audit.

During the audit, Ms Gordon provided the ATO with a false payment summary and an altered bank statement in support of her claims.

Records obtained from Ms Gordon’s employer showed that she earned no income during 2015–16. However, she did receive Centrelink payments, which she had failed to declare.

Ms Gordon was subsequently sentenced to eight months jail to be released forthwith on a 15-month good behaviour bond. She was also ordered to pay reparations of $4,316.

October 2020 – False claims lead to criminal conviction

A concreter from New South Wales has been convicted and fined for making false and misleading statements.

Mr Jason Wilson originally lodged his 2017 income tax return via a tax agent, but he lodged an amendment via myGov four months later. In the amendment, Mr Wilson falsely claimed he had worked for a second employer, where he received wages and had tax withheld. He also reported additional amounts for work-related expenses and the cost of managing tax affairs.

The false claims would have given him a $7,974 refund, but the ATO stopped the refund pending the result of an audit.

During the audit, Mr Wilson provided ATO officers with a payment summary to validate his claims. But when the auditor contacted the business in question, they confirmed the payment summary was false. He had never worked there. Mr Wilson’s tax agent also gave a statement that he was not provided with, or charged for, any financial advice.

As well as being fined $2,000 and ordered to pay a further $5,000 directly to the ATO, Mr Wilson was placed on a two-year good behaviour bond.

The Magistrate who sentenced Mr Wilson commented that although he described himself as an “unsophisticated concreter”, Mr Wilson’s conduct certainly represented sophisticated fraud. The Magistrate added that the consequences of this behaviour must be severe enough to deter the general public from doing the same.

With the end of tax time fast approaching, this case serves as a timely reminder that over-claiming will be detected. If it is deliberate, serious penalties may apply.

RESOLVING CONFLICT IN THE WORKPLACE IS NOT ALWAYS EASY

Loneliness is a powerful negative emotion. Most of us will use our words before resorting to violence, but as 2020 draws to a close we are feeling more tired and irritable than ever and our tolerance for opposing ideas wears thin, even the most outgoing people are feeling the strain.

On top of feeling lonely, tired, and mentally drained, we are in one of the most politically polarising moments in history. This is all leading to an ongoing feeling of outrage and, unsurprisingly, these feelings can spill into the workplace.

Isolation can make us less tolerant of other people’s viewpoints, so what happens when that behaviour begins to affect our working life, is there a way to disagree with colleagues without ruining work relationships?

Conversation, not antagonism

Workplace conflict can have severe negative impacts if not handled correctly. Work conflict has been linked to decreased productivity, project failure, absenteeism, and increased turnover. If you find you are trying to defend your point of view, make sure you understand what they are saying before you respond.

Isolation has given us time to sit comfortably with our own opinions. As our social circle narrows to members of our household, immediate team members and those who can be bothered ‘to Zoom’, we have fewer opportunities for those opinions to be challenged.

Even as Australia slowly comes out of lockdown, it is likely that the first people we try to catch up with are like-minded. This can make it particularly jarring when someone suddenly disagrees with you. However, taking a moment to see the other person’s point of view is going to reduce the risk of irrevocably harming your relationship with that person.

Start with something that shows you have listened. That will immediately open the conversation. You do not need to pretend you agree to show you have listened and understood. In fact, if you find their opinion confronting it might be worth telling them and asking for an explanation.

Even if it is something hopping crazy, you can say, ‘tell me how you got to that conclusion’. It just shows the other person you respect your relationship with them even if you disagree.

Choose Your Battles Wisely

Be selective of the problems, arguments, and confrontations that you get involved in. Instead of fighting every problem, save your time only for the things that matter. Remember, you do not have to win every debate, some arguments are not worth having at work so knowing when to walk away is important.

Even if it is something that you know is fundamentally wrong, you can pause and just leave that argument for another day. It might take several conversations until you are both listening to each other, but the goal is to get to that place, not necessarily to win the argument.

Once you get someone riled up the argument can blow out and you are not just discussing the original issue, you end up arguing about everything. Arguing over video calls can be particularly difficult as there is the risk of accidentally cutting people off or speaking over each other and we cannot see their body language to know when it is an accident.

If you are under pressure, it might be worth dropping the argument until you can see them in person or have more time to talk.

Do not leave without resolution

At no stage are we saying to just forget it and sweep it under the carpet or just leave them to get over it. In some teams when there is one person who disagrees with everyone else the solution is often to just move them to another team. But if you are talking about big world issues then it does not matter where you move them, someone else will be offended. You may need to ask this person to keep that particular opinion out of the workplace.

If the issue is less seclusive but has left people upset, you still need to address the cause of the problem. Do not leave it unresolved because it can grow more unpleasant or full of anger because the issue is not being properly recognised or dealt with. If you are a third party to an argument or participated in an extremely tense meeting, it is worth offering to stick around to defuse the situation.

At this moment in time, there are so many people who need a hand or are in a bad spot and we cannot keep loading our pain on to other people. We need to be conscious that we are in a unique environment where we need to double down on caring and kindness.

INSOLVENCY REFORMS TO SUPPORT SMALL BUSINESS

On 12.11.2020 the Federal Government introduced legislation into the Parliament to progress the most significant changes to Australia’s insolvency framework in 30 years as part of their economic recovery plan to keep businesses in business and Australians in jobs.

The reforms, which were announced by the Government on 24.9.2020, will reposition our insolvency system to help more small businesses restructure and survive the economic impact of COVID-19. As the economy continues to recover, it will be critical that distressed businesses have the necessary flexibility to either restructure or to wind down their operations in an orderly manner.

As part of these changes, a new debt restructuring process will be introduced for incorporated businesses with liabilities of less than $1 million, drawing on some key features of the Chapter 11 bankruptcy model in the United States.

By moving from a rigid one-size-fits-all “creditor in possession” model to a more flexible “debtor in possession” model, it will allow eligible small businesses to restructure their existing debts while remaining in control of their business.

For those businesses that are unfortunately unable to survive the economic impacts of the Coronavirus outbreak, a new simplified liquidation pathway will be introduced for small businesses to allow faster and lower-cost liquidation.

Complementary measures will also be enacted to ensure the insolvency sector can respond effectively both in the short and long term to increased demand and to the needs of small business.

Following the passage of legislation through the Parliament, these new insolvency processes will be available for small businesses from 1.1.2021.

The reforms will cover around 76 per cent of businesses subject to insolvencies today, 98 per cent of whom have less than 20 employees.

Together, these measures will reduce costs for small businesses, reduce the time they spend during the insolvency process, ensure greater economic dynamism, and ultimately help more small businesses through the recovery phase of the COVID-19 crisis.

JOBMAKER HIRING CREDIT PASSES THE PARLIAMENT

On 11.11.2020 the Federal Government passed legislation to establish the JobMaker Hiring Credit, giving businesses access to up to $200 per week for each eligible employee.

The $4 billion JobMaker Hiring Credit is a key part of the Government’s economic response to the COVID-19 pandemic.

Youth unemployment was particularly impacted by restrictions imposed as part of the health response to the COVID-19 pandemic, with the JobMaker Hiring Credit specifically designed to encourage businesses to take on additional young employees and increase in employment.

The JobMaker Hiring Credit is a fixed amount of $200 per week for an eligible employee aged 16 to 29 years and $100 per week for an eligible employee aged 30 to 35 years paid quarterly in arrears by the Australian Taxation Office.

This will help young people access job opportunities and reconnect them with the labour force as the economy recovers from the effects of the coronavirus.

To be eligible, the employee must have been receiving JobSeeker Payment, Youth Allowance (Other) or Parenting Payment for at least one of the previous three months, assessed on the date of employment.

Employees also need to have worked for a minimum of 20 hours per week of paid work to be eligible, averaged over a quarter and can only be eligible with one employer at a time.

The hiring credit is not available to an employer who does not increase their headcount and payroll. The legislative framework also prohibits both employers and employees from entering into contrived schemes in order to gain access to or increase the amount payable.

Existing rights and safeguards for employees under the Fair Work Act will continue to apply, including protection from unfair dismissal and the full range of general protections.

The JobMaker Hiring Credit will ensure hard-working Australians and businesses have the support to get back to work and is part of the Government’s Economic Recovery Plan to create jobs, rebuild the economy and secure Australia’s future.

Jobmaker Hiring Credit Bill Awaits Assent

In November, the legislation to facilitate the JobMaker Hiring Credit Scheme completed its passage through parliament and is now awaiting assent.

The Economy Recovery Package (JobMaker Hiring Credit) Amendment Bill 2020 amends the Coronavirus Economic Response Package (Payments and Benefits) Act 2020 to allow the Treasurer to make rules for a kind of COVID-19 economic response payment, primarily intended to improve the prospects of individuals getting employment or increase workforce participation.

The scheme will operate for the period from 7.10.2020 to 6.10.2022.

PENALTIES TO BE INTRODUCED FOR UNFAIR CONTRACT TERMS

In November, the Morrison Government secured the agreement of state and territory Consumer Affairs Ministers to strengthen protections for consumers and small businesses from unfair contract terms.

Evidence gathered through public consultation indicates that unfair terms remain prevalent in standard form contracts and there is uncertainty around the scope of the existing protections.

Following discussions at the November Consumer Affairs Forum, the Commonwealth and state territory governments have agreed to strengthen existing unfair contract term protections in the Australian consumer Law by:

making unfair terms unlawful and giving courts the power to impose a civil penalty

expanding the definition of small business and removing the requirement for a contract to be below a certain threshold; and

improving clarity on when the protection will apply, including on what is a ‘standard form contract’.

These reforms will improve consumer and small business confidence when entering into contracts.

Treasury will develop exposure draft legislation that will provide a further opportunity for stakeholders to comment on the detail of the reforms.

Further detail on the reforms is available on the Treasury website.

SME LOAN GUARANTEE SCHEME TURNOVER TRESHOLD LIFTED TO $120M

In November, Treasurer Josh Frydenberg registered a legislative instrument which increases the monetary threshold for annual turnover for businesses accessing the Federal Government’s Coronavirus Small and Medium Enterprises Guarantee Scheme.

The Guarantee of Lending to Small and Medium Enterprises (Coronavirus Economic Recovery Package) Rules 2020 increases the threshold from 14.11.2020 for annual turnover from $50 million to $120 million.

Phase two of the scheme commenced on 1.10.2020, which guarantees 50% of new loans issued by participating lenders to SMEs.

Key details:

loans can be used for a broad range of business purposes, including to support investment

borrowers can access up to $1 million in total

loans are for terms of up to 5 years, and a repayment holiday is not required but can be offered at the discretion of the lender

loans can be either unsecured or secured (excluding residential property)

the interest rate on loans is determined by lenders but will be capped at around 10% with some flexibility for interest rates on variable rate loans to increase if market interest rates rise over time.

This scheme is clearly of benefit to SMEs having trouble obtaining finance.

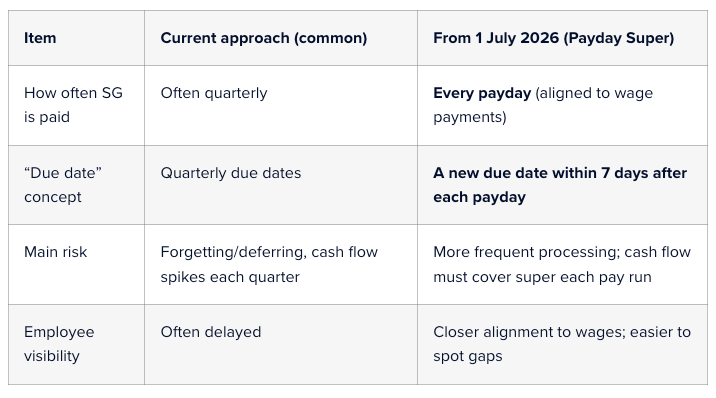

Readiness strategies in preparation for the Payday Super If you run a small business, paying Superannuation can feel like “one more admin job” on top of payroll, BAS and everything else. Two key changes mean Superannuation deserves a fresh look this year: The Super Guarantee (SG) rate is 12% for 1 July 2025 to 30 June 2026 (and remains 12% after that). From 1 July 2026, “Payday Super” starts — employers will be required to pay SG on payday , rather than quarterly, and contributions must be paid into the employee’s fund within 7 days of payday . What does SG at 12% mean in everyday terms? SG is calculated on an employee’s Ordinary Time Earnings (OTE) (often the base rate and ordinary hours, plus certain loadings/allowances depending on how they’re paid). The key point for most businesses is that the Superannuation cost is now 12 cents for every $1 of OTE. If you haven’t already, it’s worth confirming whether your staff packages are “plus super” (super on top) or “inclusive of super” (rare, but it happens). A small misunderstanding here can quietly create underpayments. What is “Payday Super” and why is it changing? Many employers pay the Superannuation Guarantee (SG) quarterly. Payday Super changes the rhythm: From 1 July 2026 , each time you pay OTE to an employee, it creates a new super payment obligation for that payday. You’ll have a 7-day due date for the SG to arrive in the employee’s fund after each payday (this is designed to allow time for payment processing). The ATO is implementing the change, and guidance is already being published to help employers prepare. This reform is aimed at reducing unpaid super and making it easier for workers to see whether super has actually been paid, closer to when they’re paid wages. Quarterly vs payday Super

A real-world case study on trust distributions Mark and Lisa had what most people would describe as a “pretty standard” setup. They ran a successful family business through a discretionary trust. The trust had been in place for years, established when the business was small and cash was tight. Over time, the business grew, profits improved, and the trust started distributing decent amounts of income each year. The tax returns were lodged. Nobody had ever had a problem with the ATO. So naturally, they assumed everything was fine. This is where the story starts to get interesting. Year one: the harmless decision In a good year, the business made about $280,000. It was suggested that some income be distributed to Mark and Lisa’s two adult children, Josh and Emily. Both were over 18, both were studying, and neither earned much income. On paper, it made sense. Josh received $40,000. Emily received $40,000. The rest was split between Mark, Lisa, and a company beneficiary. The tax bill went down. Everyone was happy. But here’s the first quiet detail that mattered later. Josh and Emily never actually received the money. No bank transfer. No separate accounts. No conversations about what they wanted to do with it. The trust kept the funds in its main business account and used them to pay suppliers and reduce debt. At the time, nobody thought twice. “It’s still family money.” “They can access it if they need it.” “We’ll square it up later.” These are very common thoughts. And this is exactly where risk quietly begins. Year two: things get a little more complicated The next year was even better. They used a bucket company to cap tax at the company rate. Again, a common and legitimate strategy when used properly. So the trust distributed $200,000 to the company. No cash moved. It was recorded as an unpaid present entitlement. The idea was that the company would get paid later, when cash flow allowed. Meanwhile, the trust needed funds to buy new equipment and cover a short-term cash squeeze. The trust borrowed money from the company. There was a loan agreement. Interest was charged. Everything looked tidy on paper. From the outside, it all seemed sensible. But economically, nothing really changed. The trust made money. The trust kept using the money. The same people controlled everything. The bucket company never actually used the funds for its own business or investments. This detail becomes important later. Year three: circular money without anyone realising By year three, things had become routine. Distributions were made to the kids again. The bucket company received another entitlement. Loans were adjusted at year-end through journal entries. What is really happening is a circular flow. Money was being allocated to beneficiaries, then effectively coming back to the trust, either because it was never paid out or because it was loaned back almost immediately. No one was trying to hide anything. No one thought they were doing the wrong thing. They were just following what they’d always done. This is how section 100A issues usually arise. Slowly, quietly, and without any single dramatic mistake.

Rental deductions maximisation strategies