Blog

08 Apr, 2024

How do Bucket Companies work? What is a Bucket Company? Ensuring a business remains profitable is one of the most important responsibilities of a business owner. So, if the business starts to generate a healthy profit, there needs to be a plan. While maximising deductions has its place in any tax planning strategy, a tax minimisation strategy that solely relies on deductions can result in sacrificing profit to lower tax when other options are available. With you and your family relying on the profits generated by your business to fund your lifestyle, it’s essential to understand the most tax-effective manner for distributing income and the best business structures that allow you to do so. Consider how a bucket company might fit into your overall tax planning strategy. Uses of Bucket Companies A bucket company (otherwise known as a corporate beneficiary) is a company set up as a trust beneficiary. This arrangement allows any income the trust distributes to the bucket company to be payable at the company tax rate, currently 25% (only if it is a base-rate entity), as opposed to the individual marginal tax rate (the top tax rate for individuals for 2023-2024 is proposed to be 47%, including the Medicare levy). They’re called bucket companies because they sit below a trust like a bucket and are used to distribute income to it. It is important to remember that there are rules around family trusts and structures within a family group. Otherwise, family trust distributions tax may apply. How do Bucket Companies work? There are generally three elements present for a bucket company: There is usually a trust with surplus income to distribute. The corporate beneficiary must fall within the definition of ‘beneficiary’ under the trust deed. Consider whether the bucket company is part of a family group. Who should hold the company’s shares? One of the main reasons bucket companies are used is to access the tax benefits they provide, and you should keep this in mind when deciding who holds the company’s shares. If an individual holds the shares, there is less flexibility in how the dividends can be distributed; they will need to be distributed according to the shareholder percentage. However, if another kind of trust holds the shares, the excess profits may be distributed, allowing for less total tax paid. Tax rates of bucket companies The bucket company pays the corporate tax rate, which could be 25% or 30%, depending on the type of company. If the company is a base rate entity, a company tax rate of 25% will apply; however, if it is not, the company tax rate will likely be 30%. Taxing trust income The general principle is that a trust’s net income is taxed by its beneficiaries; individuals and company beneficiaries pay tax on their portion of the trust’s income at the rates that apply to them. The highest marginal tax rate for individuals (not including the Medicare levy) at the time of writing this article is 45% for people with taxable income of $180,000 or more. There is a flat tax rate of 30% for non-base rate entity companies. Due to the discrepancy between the highest marginal tax rate for individuals and the company tax rate, there is at least a 15% savings potential. To illustrate, on an income distribution of $100,000, a corporate beneficiary would pay at least $15,000 less tax. Commit to distributions You must ensure that when you distribute to the bucket company for the financial year, you also distribute the same amount to the company’s bank account before lodging the tax return. In particular, trusts must distribute to corporate beneficiaries; otherwise, the Unpaid Present Entitlement (UPE) rules may be triggered. What can be done with the money in the Bucket Company? So far, in this article, we have looked at how bucket companies can help individuals save tax by paying out dividends at company tax rates. However, this is not the only bucket company strategy available. A bucket company can also hold long-term investments, such as shares, properties, or investments. In this regard, the bucket company becomes an investment company that can generate another source of income for the owner. Companies cannot access the 50% Capital Gains Tax discount, but other compelling reasons exist to use a company structure. Getting money out of the Bucket Company As has been established, the trust distributes the income to the bucket company, which begs the question: How do you get money from a bucket company? There are three ways to extract money from a bucket company: Pay dividends to the shareholders. Because the dividend has been taxed at the company rate, the shareholder will receive a franking credit to the extent that the tax has already been paid. An individual will include the dividend income as taxable income. Any excess franking credits are refundable, or top-up tax may be required depending on the shareholder’s marginal tax rate. A loan from the bucket company. As with any other loan, you must pay back the principal and interest to the bucket company. The loan is a special type called a Division 7a Loan, with requirements you will need to be mindful of. A separate discretionary trust structure can receive the dividends. Whereas the first method requires profits to be distributed according to shareholding and the second method incurs interest, this last method distributes profits according to the Trust deed. For example, using a discretionary trust as a shareholder of the bucket company allows you to make the largest distribution to an individual with the lowest marginal tax rate. Note that there may be other rules to satisfy or consider, such as Section 100A. Will a family trust structure allow a Bucket Company? To function as intended, a bucket company must be an eligible beneficiary of a family trust. As a result, you must read the trust deed to ensure the bucket company falls within the general class of beneficiaries. Additionally, a Family Trust Election may be needed depending on the structure. Consider the family group, which may define or impact who the beneficiaries are. Appropriate bucket Company strategy While bucket companies are generally useful for investors and business owners, and there is no doubt that they can be one of the most tax-effective strategies, they may not be ideal for your unique situation. A bucket company strategy may be of benefit if you are any of the following: A business owner who wants to build a nest egg for their family. A business owner who experiences significant fluctuations in income from one financial year to the next. For business owners coming up to retirement or looking to sell their business and who won’t be earning as much business income moving forward as a result Using a bucket company will not work if caught under the Personal Services Income (PSI) rules. These rules prevent individuals from reducing or deferring their income tax by diverting income they receive from their personal services through companies, partnerships, or trusts. We encourage you to seek professional advice when deciding whether a bucket company suits you.

31 Jan, 2024

CGT discount If you are selling a CGT asset, delaying the sale may be worthwhile to qualify for the CGT discount. CGT assets include land, buildings, shares, rights and options, leases, units in a unit trust, goodwill, contractual rights, licences, foreign currency, cryptocurrency, convertible notes, etc. Under the discount rules, when you sell or otherwise dispose of an asset (for instance, give the asset away), you can reduce your capital gain by 50% if both of the following apply: You owned the asset for at least 12 months, and You are an Australian resident for tax purposes. Regarding the first requirement, you must own the asset for at least 12 months before the ‘CGT event’ (usually a sale) happens. The CGT event is the point at which you make a capital gain or loss. You exclude the day of acquisition and the day of the CGT event when working out if you owned the CGT asset for at least 12 months before the ‘CGT event’ happens. To be clear: If you sell the asset and there is no contract of sale , the CGT event happens at the time of sale. If there is a contract to sell the asset , the CGT event happens on the date of the contract, not when you settle. Property sales usually work this way. If the asset is lost or destroyed , the CGT event happens when: you first receive an insurance payment or other compensation. if there is no insurance payment or compensation when the loss occurred or was discovered. You could count an asset’s previous ownership towards your 12-month ownership period if you acquired it: through a deceased estate if the asset was acquired by the deceased on or after 20 September 1985 through a relationship breakdown – you will satisfy the 12-month requirement if the combined period your spouse and you owned the asset was more than 12 months. as a rollover replacement for an asset that was lost, destroyed or compulsorily acquired if the period of ownership of the original asset and the replacement asset was at least 12 months. From 8 May 2012, the full CGT discount is not available for capital gains made by foreign or temporary residents. Returning to the theme of the article, if you held an asset for 11 months and were upon sale on track to make a capital gain of $30,000, then by delaying the sale by one month, you could reduce that gain to $15,000 by taking advantage of the 50% discount. Note that as well as non-residents, the 50% discount is not available to companies. SMSFs and trusts are both eligible (though the discount is 33% for SMSFs). Super tax offset If your spouse is a low-income earner, adding to their superannuation could benefit you financially. If you’d like to help them by putting money into their super, you might be eligible for a tax offset while potentially creating additional opportunities for both of you. Eligibility To be entitled to the spouse contributions tax offset: You must make a non-concessional (after-tax) contribution to your spouse’s super. This is a voluntary contribution made using after-tax dollars, which you don’t claim a tax deduction for. You must be married or in a de facto relationship. You must both be Australian residents. The receiving spouse’s income must be $37,000 or less for you to qualify for the full tax offset and less than $40,000 for you to receive a partial tax offset. Benefits If eligible, you can generally contribute to your spouse’s super fund and claim an 18% tax offset on up to $3,000 through your tax return. To be eligible for the maximum tax offset, which works out to be $540, you need to contribute a minimum of $3,000, and your partner’s annual income needs to be $37,000 or less. If their income exceeds $37,000, you’re still eligible for a partial offset. However, once their income reaches $40,000, you’ll no longer be eligible for any offset but can still make contributions on their behalf. Contribution limits You can’t contribute more than your partner’s non-concessional contributions cap, which is $110,000 per year for everyone, noting any non-concessional contributions your partner may have already made. However, if your partner is under 75 and eligible, they (or you) may be able to make up to three years of non-concessional contributions in a single income year under bring-forward rules, which would allow a maximum contribution of up to $330,000. Another thing to be aware of is that non-concessional contributions can’t be made once someone’s super balance reaches $1.9 million or above as of 30 June 2023. So, you won’t be able to make a spouse contribution if your partner’s balance reaches that amount. There are also restrictions on the ability to trigger bring-forward rules for certain people with large super balances (more than $1.68 million as of 30 June 2023). Joint tenants and tenants in common When buying a property with another person, you are given the option of how to be registered on the title of the property with them: joint tenants vs tenants in common. But what is the difference between the two, and is one better than the other? In this article, we explain everything you need to know. What is Joint Tenants? Joint tenants (also known as joint proprietors) means you own 100% of the property jointly with the people registered as joint tenants with you. Practically this means: When joint tenants die, the surviving owner(s) automatically become entitled to be registered as the sole owner(s) of the whole of the interest in the property. This means that any property owned in joint tenancy do not form part of a deceased’s estate, rather their interest automatically goes to the surviving owner(s). This is called “the right of survivorship”. You even split the property’s profits, losses, and risks. You cannot have an uneven share of the property. All joint tenants own the property 100% jointly. For tax purposes, the shares are even. What is Tenants in Common? Tenants in common means you have a defined ownership share of a property title. This can be 50-50, 60-40, 99-1 or any other combination. Practically this means: On the death of either of the owners, the deceased’s interest in the property passes to his or her beneficiary (not necessarily the surviving owner on the title). The beneficiary is dictated by the deceased’s Will or if they do not have a Will by State law. The defined ownership share splits the property’s profits, losses, and risks. Can you do both Tenants in Common and Joint Tenants at the Same Time? Yes, you can if you have three or more owners on the title. For example, persons A and B hold a 50% share of the property as tenants in common jointly, while person C holds their 50% share as a tenant in common individually. Practically this means: On the death of either person A or B, who holds their 50% share jointly, the survivor of A or B will get the full interest of the deceased share. Person C will not have any claim to this share as they did not hold that 50% share jointly. If Person C passes away, Persons A and B will have no automatic interest in Person C’s share of the property. Rather, person C’s share in the property will go to their beneficiary in accordance with their Will or State law if no Will exists. Touch base with us if you would like more advice about the ownership structure you should adopt when acquiring property. Superannuation downsizer Are you looking to boost your superannuation balance as you near retirement? Put simply, the intention of the downsizer contribution rules is to allow older Aussies to sell their current home and use the proceeds to contribute to their super account. Starting 1 January 2023, new rules have lowered the minimum eligibility age to allow people aged 55 and over to access downsizer contributions. Originally, the minimum age was 65, but this has progressively been lowered to age 55. The lower age limit (55 years) is based on your age when you make the contribution, and there is no upper age limit . Normally, once you reach age 75, the super rules prevent you from making voluntary contributions, so a downsizer contribution presents a rare opportunity to top up your super. There is no work test requirement to make a downsizer contribution. In fact, there is no requirement for you to have ever been in paid employment. However, you can’t claim a tax deduction for a downsizer contribution. Contribution limits Under the downsizer rules, you are allowed to contribute up to $300,000 ($600,000 for a couple) from the sale proceeds of your eligible family home. The contribution limit is the lesser of $300,000 and the gross actual sale proceeds. This means if you gift your home to a family member and the sale proceeds are $0, you cannot make a contribution. Any debt or remaining mortgage on the property does not impact the amount you are permitted to contribute to your super account. Eligible homes While the downsizer rules are generous, ensuring your home is eligible before you sell is essential. The key criteria are: You must have owned your property for a continuous period of at least 10 years. This is usually measured from the date of your original settlement when you purchased the property to the settlement date when you sell it. The property being sold must be your family home (main residence) at the time of the sale, or it must be partially exempt from capital gains tax (CGT) under the main residence exemption. The home you sell must be in Australia. Some types of property are not eligible under the downsizer rules. These include an investment property you have not lived in, caravans, houseboats and other mobile homes. Vacant blocks of land are also ineligible. If you sell your home and want to make a downsizer contribution, you are not required to buy a new home with any sale proceeds. That is, there’s no requirement to buy a cheaper or smaller home after making your downsizer contribution, so you can even decide to purchase a more expensive replacement home. Caution The costs involved in selling a family home can be substantial. If you purchase another home, sales commissions, moving costs, stamp duty, and land taxes mount up, so think carefully before deciding to downsize. Remember, selling a large home and downsizing to a smaller property does not always release much excess capital (particularly in a capital city), so do careful calculations on how much you will have left to contribute to super before selling.

31 Jan, 2024

ATO Debt Alert The federal government’s Mid-Year Economic and Fiscal Update (MYEFO), released in December, announced that the general interest charge (GIC) would soon no longer be deductible for individuals and businesses. By way of background, GIC is imposed by the ATO, and it applies to unpaid tax liabilities, such as when: an amount of tax, charge, levy or penalty is paid late (or is unpaid) there is an excessive shortfall in an incorrectly varied or estimated income tax instalment. GIC is calculated on a daily compounding basis on the amount outstanding. Generally, the amount of GIC applied is notified in a: statement of account late payment notice GIC notice. The annual rate of GIC is 11.15%, increasing to 11.38% for the January to March 2024 quarter. With such a high-interest rate and daily compounding, it is prudent to prioritise ATO debts over other debts. This new MYEFO measure means taxpaying entities, including individuals and small businesses, will have to face up to their GIC penalties without the prospect of a tax deduction. The federal government states the changes will enhance incentives for all entities to self-assess their tax liabilities and pay on time correctly and level the playing field for individuals and businesses who already do so. In effect, removing tax-deductible status will eke away at what is left of the ATO’s leniency towards overdue tax obligations. The change is expected to result in extra tax revenues of $500 million annually from 1 July 2025. TIP After an extended period of leniency shown to individuals and businesses struggling through COVID-19 and its aftermath, 2022 and 2023 marked a reversion to the norm. If taxpayers fail to engage with the ATO to satisfy their outstanding debts, enforcement actions may be escalated accordingly. In that respect, the ATO has the discretion to: Issue garnishee notices and director penalty notices (‘ DPNs ’) Report outstanding tax debts to a Credit Reporting Bureau if action to manage the debt is not taken within 28 days of receipt of a notice of intent. This can have a crippling effect on your and your business’s ability to borrow and Otherwise, commence legal action, including issuing summons for non-lodgements, and otherwise progressing personal and caproate insolvency action, including creditors’ petitions and winding-up proceedings. The surest way to prevent the above action from being taken is to enter into (and comply with) a payment arrangement with the ATO about your debts. Contact us if you would like us to do this on your behalf. Christmas Shutdowns With Christmas on our doorstep, some new rules exist around annual leave during business shutdowns. To recap, a shutdown is when a business temporarily closes during specific periods, such as between Christmas and New Year. By contrast, a stand down is when an employer tells employees not to work because they can’t be usefully employed for reasons outside the employer’s control. Reasons for a stand down can include: equipment breakdown if the employer isn’t responsible for it. industrial action, when the employer does not organise it. a stoppage of work for a reason the employer can’t be held responsible, such as a natural disaster. An employee can be directed to take annual leave during a shutdown if their award or registered agreement allows it. Suppose an Award or registered agreement does not cover an employee. In that case, they can be ordered to take annual leave if it is reasonable in the circumstances and their employment instrument (such as a contract) does not prohibit it. From 1 May 2023, many awards have updated the rules on taking annual leave during a shutdown. The new rules mean: employers may require employees to take paid annual leave during a temporary shutdown. employers must provide at least 28 days written notice of the temporary shutdown period to all impacted employees. the requirement to take annual leave must be reasonable. the notice period can be reduced through an agreement between the employer and most impacted employees. an employee who doesn’t have enough paid annual leave to cover the whole period can form an agreement with their employer for other options for the days not covered, such as: using accrued time off. annual leave in advance, or leave without pay. Note that during shutdowns, the employee must be paid for any public holidays during the shutdown period that fall on days they would typically work. These new rules apply to employees and employers covered by one of the affected awards. Fair Work has updated its website with directions to take annual leave during a shutdown. This includes popular awards and industries like: building and construction hair and beauty hospitality (including fast food and restaurants) real estate. Access your industry from Fair Work’s Direction to take annual leave during a shutdown page. Just select your industry from the drop-down menu to get award-specific information. Christmas Tips for Retail Businesses Here are some tips to employ this holiday season for businesses operating in the retail sector as follows: Last-minute adjustments to inventory. Executive director for the Australian Retailers Association says now is an ideal time to ensure you have the right balance of stock on hand to meet your customers’ needs: “Whether you’re a single shopfront or a nationwide chain, you probably should have planned your inventory up to five or six months in advance. But now is a great time to make tweaks to your inventory.” Carefully balance foot traffic, wages, and opening hours Retailers in shopping centres generally must play by the facility’s rules; otherwise, every retailer should try to assess their opening hours according to their needs. Everyone knows to expect extended shopping hours generally begin in December, but that doesn’t mean every business should attempt to match those hours. Wages increase by up to 25% after 6 pm, and there’s no point paying those extra wages if you won’t realise a proportional increase in foot traffic. Christmas is also the ideal time to trial new and junior staff members who can help with odd jobs like stacking and packing. Make the most out of digital marketing Modern marketing techniques like email direct marketing, search engine marketing and social media can all achieve great results – even if you’re not selling online. Social media is how to get advertising out there at a minimal price. All retailers should ensure they’re present and active on their local community Facebook page to promote their offerings, hours and any special events they might have come up with. Review your pricing strategy – it’s not always about the most significant discount With the likes of Amazon in the market, many retailers are responding by dropping their prices – but that’s not always the best approach. For example, suppose you are looking to buy a nice shirt. In that case, you may be happy to pay a little extra at your local store if it can offer free alterations with the purchase, which is generally better value than spending a little less at one of the more prominent brands that don’t provide this service. People are likely to look at different products for different reasons, which must be considered when determining how to price your products. Most importantly, retailers must know the consumer law around advertising discounts. The ubiquitous “WAS $X, NOW $Y” is something that can catch retailers out because the ‘was’ price must be proven to be offered in the store or at some point sold at that price; otherwise, you may get stung by the Australian Consumer and Competition Commission (ACCC). Share the Festive Cheer – Especially With your best customers It’s an age-old retail tenet, and it’s as accurate today as it ever has been, it’s much cheaper to retain an existing customer than to acquire new ones. Christmas is the ideal time to celebrate the people who support you, and it doesn’t have to be a costly exercise. Rather than offering special customer discounts, consider adding something to your regular customers’ basket at no cost. The customer may see an extra 10 dollars of retail value in their basket, but that item probably only cost your business five dollars – and the more thought you’ve put into the gift, the more they’ll appreciate you for it. Other Festive Season Tips From a tax standpoint, keep good records of your work Christmas party – receipts, cost per head, who attended, the venue, etc. This will significantly assist your accountant in determining the party’s tax deductible and any potential fringe benefits tax (FBT) liability, including any applicable exemptions. Notify critical customers and suppliers of the dates of any shutdown period that your business may have. All staff should set up automatic, out-of-office replies on their email, notifying recipients of their leave dates over Christmas and noting that the leave period may differ between employees. Make a mental note of your computer passwords. These are easy to forget if you are away for a few weeks. However, please don’t make a handwritten note and leave it on your desk ready for your return! Use your phone mainly just for texting and calling over the holidays – allowing you to give your full attention to the family and friends you are with over the break. In other words, reconnect!

05 Dec, 2023

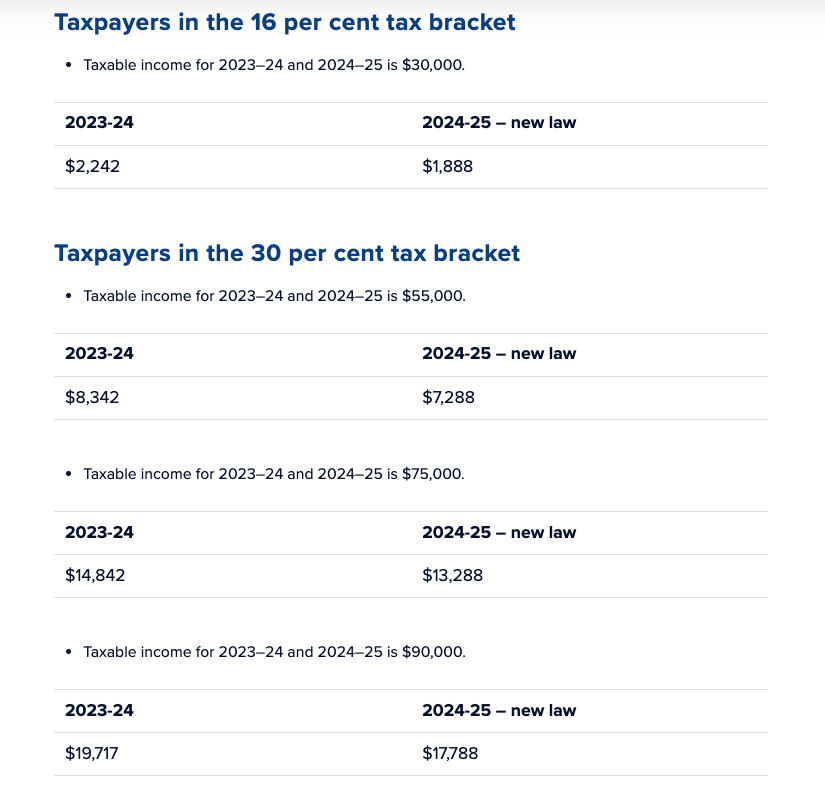

Stage 3 Tax Cuts The Federal government has reaffirmed its commitment to the so-called Stage 3 Tax Cuts. By way of background, the previous government legislated these tax cuts. They will abolish the current 37 per cent tax bracket, lower the existing 32.5 per cent bracket to 30 per cent, and raise the threshold for the top tax bracket from $180,001 to $200,001. You can see what that means by looking at the table below. It shows how the personal income tax rates and thresholds will change in the 2024-25 financial year. Tax RateCurrent 2023/24 ThresholdsTax RateNew thresholds from 1 July 2024 Nil Up to $18,200 Nil Up to $18,200 19% $18,201-$45,000 19% $18,201 – $45,000 32.5% $45,001-$120,000 30% $45,000 to $200,000 37% $120,001-180,000 45% $180,001 and over 45%. $200,001 and over The result will be that the first $18,200 you earn will be tax-free (as it is currently), and every dollar you earn between that and $45,000 will be taxed at 19% (as it is presently). But then things change. From July 1, 2024, every taxable dollar you earn from $45,001 to $200,000 will be taxed at 30%, and every dollar you earn above $200,000 will be taxed at 45%. That’s very different from what currently happens. On the face of it, lowering the 32.5% bracket to 30% and removing the 37% tax bracket altogether seems like a big win for middle and upper-middle-income earners. But it will be a much bigger win for higher-income earners in dollar terms. Please reach out to us when these cuts begin in July next year to figure out your tax position. Advantages of company structure There are many advantages of operating your business via a company structure, including: Liability for shareholders is limited. It’s easy to transfer ownership by selling shares to another party. The company can employ shareholders (often family members). The company can trade anywhere in Australia. Taxation rates can be more favourable. You’ll have access to a broader capital and skills base. Reduced personal responsibility for any business debts incurred. Legal liability also becomes reduced since a company is a separate legal entity from you as an individual. Company tax rates are lower compared to higher marginal tax rates. It can be much easier to raise finance and capital to grow and expand your business. Director Liability Chief among the advantages of company structure benefit these is asset protection. Broadly speaking, company owners are protected from creditors if their company fails. However, there are two notable exceptions! The first of these is where a director offers a personal guarantee. Companies often require financial support to secure loans, leases, or credit facilities to foster growth and development in the dynamic business world. To assure lenders or creditors, directors of companies in Australia may be asked to offer personal guarantees. These guarantees, known as “Directors’ Guarantees”, play a crucial role in ensuring that the obligations of a company are met. Such guarantees are essential for three reasons: Access to Funding: By providing a personal guarantee, directors can help their companies access financing that might otherwise be difficult to obtain, especially for new businesses. Credibility: A director’s willingness to guarantee a company’s obligations can enhance the company’s credibility and trustworthiness in the eyes of creditors and prospective business partners. Risk Mitigation: For creditors, a Directors’ Guarantee serves as a safety net, ensuring that someone personally takes responsibility for the company’s obligations, reducing the risk of financial loss. Directors should know that providing a Directors’ Guarantee carries significant personal risk. If the company defaults on its obligations and the director cannot cover the debt, its personal assets may be at risk. Along with director guarantees, owners of companies may also be personally liable under the director penalty notice regime. As a company director, you become personally liable for your company’s unpaid amounts of: Pay as-you-go withholding (PAYGW) Gods and services tax (GST) Super guarantee charge (SGC). These amounts that you are personally liable for are called director penalties. The ATO can recover the penalty amounts once they issue a director penalty notice. To be clear, a director is responsible for ensuring the company meets its PAYGW, net GST and SGC obligations in full by the due date. If these obligations are not met, directors become personally liable for director penalties unless they take steps to ensure the company lodges and pays its: PAYGW by the due date, Net GST (as well as Luxury Car Tax and Wine Equalisation Tax amounts) by the due date and Superannuation guarantee (SG) to employees’ superannuation funds by the due date – if that doesn’t occur, the company must lodge a superannuation guarantee statement and pay the resulting SGC liability. Talk to us if you are still determining your director’s liabilities. Business Plan The upcoming Christmas break is an opportune time to review a business plan. A business plan can be used to: help you start a new business. help you improve the performance of an existing business. attract funding for an investment. communicate business progress to stakeholders. communicate business goals and objectives to internal staff members. attract potential buyers for the business. A business plan is a ‘living’ document, so it should evolve and change—think of it an operating guide for your business throughout the start-up, operations and succession phases. The elements of a business plan will vary depending on: phase of the business is in (starting, running, selling). the industry a business is in. the use of the plan (e.g. for internal development purposes). Every business plan will be different but generally include the elements below. Executive summary This section provides an overview of the business concept. It should be attention-grabbing and concise—the content will be covered in more detail in future sections. While this is the first section of the plan, it can often help to write it last after the other sections have been finalised. This helps to ensure that the executive summary covers all the key information within the plan. It should define: business vision legal structure products and services customers competitors market and products or services operation financial projections evolution of the business and the industry structure of the business short-term and long-term goals Product, service and market analysis In this section, you should highlight your business products and services and describe what makes them unique, such as their: features benefits limitations cost and sale price. You can also include details of any business plans to introduce new products and services. Your market analysis should describe your target market (e.g., local, international) and target customers. Add in the research you have done about your industry and the market trends. In this section, you will also complete a SWOT analysis (strengths, weaknesses, opportunities, threats). Sales Explain your sales forecasts and targets in this section and how you will manage customer records and payments—understanding what sales strategies will work for you and the best channels to market your products or services. You will also need to know your current sales, volume and market share and what you expect them to be for the coming year. You should also identify your break-even point – the sales volume required to keep the doors open. Operating plan This section will cover all you know about how you do things in your business—for example, your standard operating procedures and how to ensure the quality of your products and services. Financial plan Summarise your key financial details, including: costs for establishing or operating the business. sales needed to break even. projected cash flow. funding arrangements. payment plans. Action plan The final section of the business plan should include a set of actions to take before you review your business plan and check your progress. This should be over 6–12 months, based on the business goals outlined in your plan. Set a regular review date for the actions and the business plan. Assess which actions have been completed, which remain outstanding, and require updating to help your business plan remain relevant. Review As noted, the Christmas break is an excellent time to review your business plan to ensure that it’s relevant, achievable and up to date with any changes in your business. To help you review your plan, ask yourself the following questions: What will the review schedule be? Is the plan up to date? Have the business goals changed? Does the plan still match the business goals? Are market trends changing? Have significant political, environmental, social or technological changes affected your business? Have there been significant changes in your finances or need for capital? Benchmarking your business Have you benchmarked the performance of your business? The ATO provides a high-level benchmark tool for business owners to compare their company’s performance to a broader range of similar businesses. There are essentially three purposes behind the ATO Small Business Benchmark Tool. These are: encourage business owners to perform annual health checks to see if their costs are above or below their peers. enable businesses to assess whether any discrepancies may be flagged for an audit by the ATO and to alert the ATO to investigate businesses outside the benchmarking norm. Financial benchmarking has been a valuable tool for businesses across various industries for decades, as it is an effective way of identifying issues and facilitating sound business decisions. The ATO says: “When we see a business significantly outside the key benchmark range for their industry, it doesn’t necessarily mean you have done anything wrong. But it indicates something unusual and may prompt us to contact you for further information”. In conclusion, the ATO Benchmark Tool is a valuable resource for small businesses to see how you’re tracking against businesses of a similar type. Access the benchmarks on the ATO website and contact us if you have any questions.

13 Nov, 2023

Tax issues for businesses that have received a support payment Taxpayers who have received a government support grant or payment recently to help their business recover from COVID-19 or a natural disaster should check if they need to include the payment in their assessable income. Grants are generally treated as assessable income, and taxpayers may be able to claim deductions if they use these payments to: purchase replacement trading stock or new assets; repair their business premises and fit out; or pay for other business expenses. However, some grants are declared non-assessable, non-exempt ('NANE') income. This means taxpayers don't need to include them in their tax return if they meet certain eligibility requirements. NANE grants include but are not limited to: COVID-19 business support payments; natural disaster grants; and water infrastructure payments. Taxpayers can only claim deductions for expenses associated with NANE grants if they relate directly to earning their assessable income, including wages, dividends, interest and rent. Taxpayers cannot claim expenses related to obtaining the grant, such as accountant's fees. Care required in paying super benefits Generally, before SMSF trustees pay a member's super benefits, they need to ensure that: the member has reached their preservation age; the member has met one of the conditions of release; and the governing rules of the fund (e.g., the trust deed) allow it. Benefit payments to members who have not met a condition of release are not treated as super benefits. Instead, they will be taxed as ordinary income at the member's marginal tax rate. If a benefit is unlawfully released, the ATO may apply significant penalties to: the SMSF trustee; the SMSF; and the recipient of the early release. The ATO may also disqualify the trustee(s) involved. Investment restrictions and other rules that apply to SMSFs in the accumulation phase continue to apply when members begin receiving a pension from the SMSF. Where a member has met a condition of release, the trustee can either pay the benefit as a lump sum or super income stream (i.e., a pension). If a member has died, the trustee will generally pay a death benefit to a dependant or other beneficiary of the deceased, subject to the applicable rules. Notice of visa data-matching program The ATO will acquire visa data from the Department of Home Affairs for the 2024 to 2026 income years, including the following: n address history and contact history for visa applicants, sponsors, and migration agents; n active visas meeting the relevant criteria, and all visa grants; n visa grant status by point in time; n migration agents who assisted the processing of the visa; n all international travel movements undertaken by visa holders; and n sponsor details, and visa subclass name. The ATO estimates that records relating to approximately nine million individuals will be obtained each financial year. The objectives of this program are to (among other things) help ensure that individuals and businesses are fulfilling their tax and super reporting obligations, and identify potentially new or emergent approaches to fraud and those entities controlling or exploiting the visa framework. ATO says: "Be cyber wise, don't compromise" Throughout the 2022 income year, one cybercrime was reported every seven minutes. The ATO encourages taxpayers to implement the following four quick steps to protect themselves. Step 1: Install updates for your devices and software Regular updates ensure taxpayers have the latest security in place which can help prevent cyber criminals from hacking their devices. They should also make sure they are downloading authorised and legitimate programs. Step 2: Implement multi-factor authentication Multi-factor authentication ('MFA') is a security measure that requires at least two proofs of identity to grant access. Businesses as well as individuals should implement MFA wherever possible. MFA options can include a physical token, authenticator app, email or SMS. Step 3: Regularly back up your files Backing up copies of files to an external device or the 'cloud' means taxpayers can restore their files if something goes wrong. It is a precautionary measure that can help avoid costly data recovery. Step 4: Change your passwords to passphrases By using passphrases, taxpayers can boost the security of their accounts and make it harder for cyber criminals to access their information. Passphrases use four or more random words and can include symbols, capitals and numbers. A password manager can help generate or store passphrases. Losses in crypto investments for SMSFs Over the last few income years, the ATO has seen some instances of SMSF trustees losing their crypto asset investments. These losses have been caused by: crypto scams, where trustees were conned into investing their superannuation benefits in a fake crypto exchange; theft, where fraudsters would hack into trustees' crypto accounts and steal all their crypto; collapsed crypto trading platforms, many of which were based overseas; and lost passwords, resulting in trustees being locked out of their crypto account and being unable to access their crypto. Trustees thinking of investing in crypto need to be aware of the ways that crypto can be lost, including through scams, and how these scams can be avoided. Many crypto assets are not commonly considered to be financial products, which means the platform where crypto is bought and sold may not be regulated by ASIC. Therefore, trustees may not be protected if the platform fails or is hacked. When a crypto platform fails they will most likely lose all of their crypto. Investing in crypto can be complex and risky, and so the ATO recommends that trustees seek financial advice before investing.

30 Oct, 2023

Christmas Parties and FBT With work Christmas parties just around the corner, we look at the tax treatment of such occasions. Key concepts To begin with, there are two critical issues to understand. Entertainment Typically, fringe benefits tax (FBT) will only apply to a party if it involves the provision of ‘entertainment’. This means the provision of (a) entertainment by way of food, drink, or recreation, or (b) accommodation or travel in respect of such entertainment, such as taxis, hotel accommodations, etc. In this case, recreation includes amusement, sport and similar leisure-time pursuits and provides recreation and entertainment in vehicles, vessels or aircraft (for example, joy flights, sightseeing tours, harbour cruises). Minor Benefits In simple terms, a minor benefit is provided to an employee/associate (spouse) if done so on an infrequent or irregular basis (typically, no more than twice per year), and the cost is less than $300 inclusive of GST per employee/associate. This is $300 per expense (i.e., $300 per meal and drinks and a separate $300 per accommodation, etc.). Note that for this piece, we will assume the employer (like most employers) uses the Actual method to calculate FBT, whereby FBT is paid only to employees and their associates (not clients or other outside individuals). Venue Business premises Holding your Christmas party on the business premises on a working day (logically, Friday after work) usually gives an employer the most tax-effective outcome. Expenses such as food and drink are exempt from FBT for employees with no dollar limit, but no tax deduction or GST credit can be claimed. The reason why FBT does not apply is because there is typically no “recreational” component in play. Thus, the following rules apply to parties on the business premises: EmployeesTax TreatmentFood and drink per person (no dollar limit) –No FBT applies, no tax deduction, and no GST credit is claimable.Recreation (e.g., band) per person < $300 –No FBT, no deduction, no GST credit.Recreation $300 or more –FBT applies, is tax deductible, and GST credit is available.AssociatesFood and drink <$300 per person –No FBT, no deduction, no GST creditd and drink $300 or moreFBT applies, is tax deductible and GST credit availableRecreation <$300-No FBT, no tax deduction, no GSTRecreation >$300-FBT applies, is tax deductible and GST credit available. EXAMPLE – Christmas party on business premises A company holds a Christmas lunch on its business premises on a working day. Employees, their partners and clients attend. The company provides food and drink and taxi travel home. The cost per head is $125. Entertainment is being provided. A party for employees, associates and clients is entertainment because the purpose of the function is for the people attending to enjoy themselves. Employees – no FBT; exemption applies. The employer doesn’t pay FBT for the following: food and drink for employees, because it is provided and consumed on a working day on the business premises. taxi travel because there is a specific FBT exemption for taxi travel directly to or from the workplace. Associates – no FBT; exemption applies. The employer doesn’t pay FBT for the food, drink and taxi travel provided to the employees’ partners (associates) because it is a minor benefit – that is, it has a value of less than $300, and it would be unreasonable to treat it as a fringe benefit. Clients – no FBT There is no FBT on benefits provided to clients. Income tax and GST credits The employer can’t claim an income tax deduction or GST credits for the food, drink or taxi travel provided for employees, associates, or clients. Offsite (e.g., restaurant) The party is held offsite, and the tax treatment is slightly different as follows: EmployeesTax TreatmentFood and drink <$300 per person –No FBT, no deduction, no GST credit.Food and drink $300 or more –FBT applies, tax-deductible, GST credit available.Recreation (e.g., band) <$300 – No FBT, no deduction, no GST credit.Recreation $300 or more –FBT applies, tax-deductible, GST credit available.AssociatesFood and drink <$300 per person-No FBT, no deduction, no GST credit.Food and drink $300 or more –FBT applies, tax-deductible, GST credit available.Recreation <$300 –No FBT, no deduction, no GST.Recreation >$300 or more –FBT applies, tax-deductible, GST credit available. Clients Irrespective of the cost or the party’s location (business premises or offsite) under the Actual method, there is no FBT, nor is there a tax deduction or GST credit available for food and drink or any recreation component provided to clients or suppliers. The reason for this is that FBT applies to employment. As a result, clients and suppliers fall outside the FBT system (except where the employer elects to use the 50/50 method to calculate their FBT liability). Christmas Gifts and FBT To correctly determine the tax treatment of a gift given to an employee or their associate, e.g., spouse (not just at Christmas time but at any time during the year), a distinction needs to be drawn as to whether the gift is categorised as a “non-entertainment gift” or on the other hand as “entertainment”. “Entertainment” type gifts include movie theatre tickets, sporting tickets, holiday vouchers or admission to an amusement centre. Whereas “Non-Entertainment” type gifts include Christmas hampers, a bottle of whiskey or wine, gift vouchers, perfume, flowers or a pen set. For gifts given to entertainment-based clients, no FBT is applicable nor a tax deduction is available. However, these would be tax deductible if you give a client a bottle of wine, a carton of beer or a Christmas ham rather than movie tickets. Mindful of this, the treatment is as follows: Entertainment gifts EmployeesTax TreatmentCost <$300 per person –No FBT, no deduction, no GST credit$300 or more –FBT, tax-deductible, GST credit availableAssociates<$300 –No FBT, no deduction, no GST credit> $300 or more –FBT applies, tax-deductible, GST credit available Non-entertainment gifts EmployeesTax TreatmentCost <$300 per person –No FBT, no deduction, No GST credit$300 or more –FBT, deduction deductible, GST credit availableAssociates<$300 –No FBT, tax-deductible, GST credit available$300 or more-FBT applies, tax-deductible, GST credit available No FBT would apply for gifts costing less than $300 to employees and associates, but these are tax-deductible, so feel free to hand out Christmas hams, perfume or shopping vouchers. This is the most tax-effective and economic option. The rules regarding the minor benefit exemption have changed, so you should feel free to give the gifts at the Christmas Party rather than a few weeks before, as was previously the case. This is because the gift and the cost of the function are considered separate benefits and have their own $300 threshold. The FBT implications for Christmas parties and gifts can be quite complicated. There are many different variables and combinations that can change the tax-deductible nature and the fringe benefits implications for having an event or giving a gift. Speak with us if you have any questions. Refinancing is the process of replacing an existing loan with a new one, usually with better terms and interest rates. Pros Some lenders are offering up to $5,000 in refinance cashbacks. These, however, are subject to qualifying criteria regarding the loan amount and LVR, etc. Borrowers may be able to secure lower interest rates elsewhere. If you’re refinancing to a lower interest rate, lower repayments can help you manage your finances. Access to more loan features. Your current home loan may not have the parts you require, like redraw and offset, or one that gives you flexible repayment options so you can pay off your mortgage faster. Cons When you’re refinancing to another lender, there are fees involved. It could amount to thousands of dollars, from discharge fees to setting up a new loan. If you have less than 20% equity, you might have to pay Lenders Mortgage Insurance (LMI) fees, even if you’re refinancing with the current lender. When you refinance, you are applying for another home loan, which will make a credit enquiry. If you keep making refinancing applications, it will leave too many questions quickly, lowering your credit score. When you refinance, it resets the loan term. If you’ve already paid off five years of your 30-year loan term, if you refinance to another lender, then you’re potentially back to paying 30 years’ worth of interest again. Tax From a tax standpoint, refinancing with another loan does not change interest deductibility. For example, Jack has a loan with ANZ bank, which was used to acquire an investment property. He refinances this with AMP. Because the interest was deductible before, it is deductible after the refinance (see Taxation Ruling TR 95/25 in paragraph 47). Furthermore, interest on a new loan will be deductible if the new loan is used to repay an existing loan which, at the time of the second borrowing, was being used in an assessable income-producing activity or used in a business activity which is directed to the production of assessable income (Taxation Ruling TR 2000/2). Consolidating Your Superannuation You may be able to transfer your existing super account(s) to another complying fund (known as a rollover), depending on the rules of your super funds. For example, you can transfer your super to consolidate multiple accounts. Putting all your super in one account means paying only one set of account fees. Differences in fees can significantly affect the amount you have when you retire. Having fewer accounts also makes it easier to keep track of your super. Think about the possible consequences before deciding to roll over your super. Ask your existing super fund about any fees or charges that will apply or any loss of entitlements such as life insurance. You should also consult the receiving super fund to ensure they will accept a rollover of your super. The preservation rules apply to benefits rolled over to another complying super fund. This means benefits can only be accessed once you meet a condition of release, such as reaching 65. Sometimes, your super may be rolled over to another super fund without you requesting it, such as when two super funds merge. Tax No tax is payable on the amount rolled over to another complying super fund until you withdraw your super, when tax may apply. If a super benefit is paid directly to you before being born into another fund, the payment is considered outside the excellent system. It will be treated as a super benefit rather than a rollover, in which case it may be taxed. If you roll over an amount wholly or partly of an untaxed element that exceeds the untaxed plan cap amount, the transferring fund will withhold the tax payable on the excess amount. Considerations Check with both super funds, particularly the transferring fund, so you know of any applicable fees or charges, any effect on your benefits, and any loss of entitlements such as insurance. The fund you want to transfer to may not accept transfers from other funds or ATO-held super–checks before starting your transfer. There are no fees or charges for transferring ATO-held super money into a super fund account. Check that both the account you’re planning to transfer super from and the account you’re planning to move it to are still open, as there can be delays in funds reporting closed accounts to us. Check that neither of the funds has restrictions on actioning the transfer. There are some essential factors to consider before transferring your super: Differences in fees can significantly affect the amount you have when you retire. The fund you want to leave could charge administrative, exit, or withdrawal fees. The fund you want to transfer may charge entry or deposit fees. The fund you want to leave may insure you against death, illness or an accident that prevents you from returning to work. If you leave this fund, you may lose these entitlements – check if the other fund offers comparable cover. ATO online services flag any super account with insurance with a ‘Yes’ indicator. Transferring your funds will not change the super fund your employer pays your contributions to. Speak with your employer about whether you can choose a different fund and advise them of the new fund account details for future contributions. If unsure what to do, seek independent financial advice or contact your super fund. How? You can request a transfer of the whole of a super account balance online by: sign in to myGov. select the Australian Taxation Office. select Super, then Manage, then Transfer Super. Completing the rollover or transfer request using ATO online services lets you view all your super accounts in one place. You can only transfer a whole account balance from one super fund to another using ATO online services or the paper form, as this process involves closing the account. If you want to transfer part of your super account balance, contact the super fund from which you wish to transfer money.

01 Sept, 2023

Appointing an SMSF auditor The ATO reminds SMSF trustees that they need to appoint an approved SMSF auditor for each income year, no later than 45 days before they need to lodge their SMSF annual return. An SMSF’s audit must be finalised before the trustees lodge their SMSF annual return, as the trustees will need some information from the audit report to complete the annual return. An SMSF’s auditor is to perform a financial and compliance audit of the SMSF’s operations before lodging. An audit is required even if no contributions or payments are made in the financial year. An approved SMSF auditor must be independent, which means that an auditor should not audit a fund where they hold any financial interest in the fund, or have a close personal or business relationship with members or trustees. If a fund doesn’t meet the rules for operating an SMSF, the auditor may be required to report any contraventions to the ATO. ATO gives 'green light' to lodge The ATO is giving taxpayers with simple affairs the ‘green light’ to lodge their annual income tax returns. ATO Assistant Commissioner Tim Loh said that most taxpayers with simple affairs will find the information they need to lodge has now been pre-filled in their tax return. Mr Loh also reminded taxpayers that some income may need to be manually added – for example, income from rental properties, some government payments or income from ‘side hustles’. As taxpayers prepare to lodge, they should keep ‘Tim’s tax time tips’ in mind: Include all income: If a taxpayer picked up some extra work, e.g., through online activities, the sharing economy, interest from investments, etc, they will need to include this in their tax return; Assess circumstances that occurred this year: If a taxpayer’s job or circumstances have changed this year, it is important they reflect this in their claims; Records, records, records: To claim a deduction for a work-related expense, taxpayers must have a record to prove it. Wait for notice of assessment: Taxpayers should wait for their notice of assessment before making plans for how they will use any expected tax refund this year; Stay alert to scams: The ATO would never send taxpayers a link to log into the ATO’s online services or ask them to send personal information via social media, email or SMS. Editor: The ATO advises that, when taxpayers lodge their own return, the due date for payment is 21 November, regardless of when they lodge, but If they use a registered agent, their due date can be much later. Different meanings of 'dependant' for superannuation and tax purposes On a person’s death, their superannuation benefits can only be paid directly to one or more ‘dependants’ as defined for superannuation purposes, unless they are paid to the deceased’s legal personal representative to be distributed in accordance with the deceased’s Will. Super death benefits can be tax-free to the extent that they are paid (either directly or indirectly) to persons who are ‘dependants’ for tax purposes. However, the meaning of ‘dependant’ differs slightly for superannuation and tax purposes. For superannuation purposes, a ‘dependant’ of the deceased comprises: their spouse (including de facto spouse); heir child (of any age); a person in an ‘interdependency relationship’ as defined with the deceased; and a person who was financially dependent on the deceased. However, for tax purposes, a ‘dependant’ (or ‘death benefits dependant’) of the deceased includes their spouse or former spouse (including de facto spouse) and only children under the age of 18. Therefore, super death benefits generally cannot be paid directly to a former spouse, as they are not a dependant for super purposes. Also, while a child of any age is a dependant for super purposes, only children under the age of 18 are dependants for tax purposes. This means that, while a child of any age may receive super death benefits directly, those benefits will generally only be tax-free if the child is under 18. Editor: If you are thinking about estate planning with your superannuation, please contact our office. NALI provisions did not apply to loan structure The Administrative Appeals Tribunal (‘AAT’) has held that interest income derived by a self-managed superannuation fund (‘SMSF’) as the sole beneficiary of a unit trust was not non-arm’s length income (‘NALI’), and so this income could still be treated as exempt current pension income. During the 2015, 2016 and 2017 financial years, the unit trust lent money through two related entities to independent third parties who undertook development activities, through a series of loan arrangements. The interest income derived by the unit trust through these loan arrangements was distributed to the SMSF as sole unitholder and was treated as exempt current pension income. Following an audit, the ATO determined that the income was NALI, and therefore should not have been included as exempt current pension income. The ATO then issued amended assessments for the relevant financial years, along with penalties. While the AAT found that the parties were not dealing with each other at arm’s length, it also concluded that the income that the unit trust derived was not more than the amount it might have been expected to derive if the parties had been dealing at arm’s length. Accordingly, the relevant interest income received by the SMSF was not NALI, and so the taxpayer’s objections to the amended tax assessments and penalties were allowed. Luxury car tax: determining a vehicle's principal purpose The ATO recently explained how to determine the principal purpose of a car for ‘luxury car tax’ (‘LCT’) purposes (since LCT is not payable on the supply or importation of cars whose principal purpose is the carriage of goods rather than passengers). Broadly, a luxury car (i.e., a car subject to LCT) is a car whose LCT value exceeds the LCT threshold. However, a commercial vehicle that is not designed for the principal purpose of carrying passengers is specifically excluded as a luxury car. The ATO’s new determination sets out various factors to be considered in determining the principal purpose of a car, as well as factors to consider when assessing a car’s modifications. The determination states that commercial vehicles are unlikely to have the body types of station wagons, off-road passenger wagons, passenger sedans, people movers or sports utility vehicles, and the supply of these vehicles for an amount above the LCT threshold without LCT being paid may well attract the ATO’s scrutiny.

© 2024

Borg & Salce Accountants

29 + Years of Experience

We offer specialised accounting, taxation, SMSF and bookkeeping services to our professional clients. Borg & Salce are based in Epping, Victoria and provide our service to clients around the city of Whittlesea, but also to other areas including the northern suburbs, greater Melbourne, metro and nationally.

Ph: 03 9408 9633

Fax: 03 9408 9644

9am to 5.30pm Monday to Friday and Saturday By Appt Only

738A High Street, Epping, VIC 3076